does workers comp deduct taxes

But if you receive a lump-sum payout or a settlement from a common law claim. Find out if you qualify for Workers Compensation Today.

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

. As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from your. Youll want to make sure to keep track of your premium payments and include them at tax time. WorkCover should send you a statement of payments like a PAYG summary that you can use.

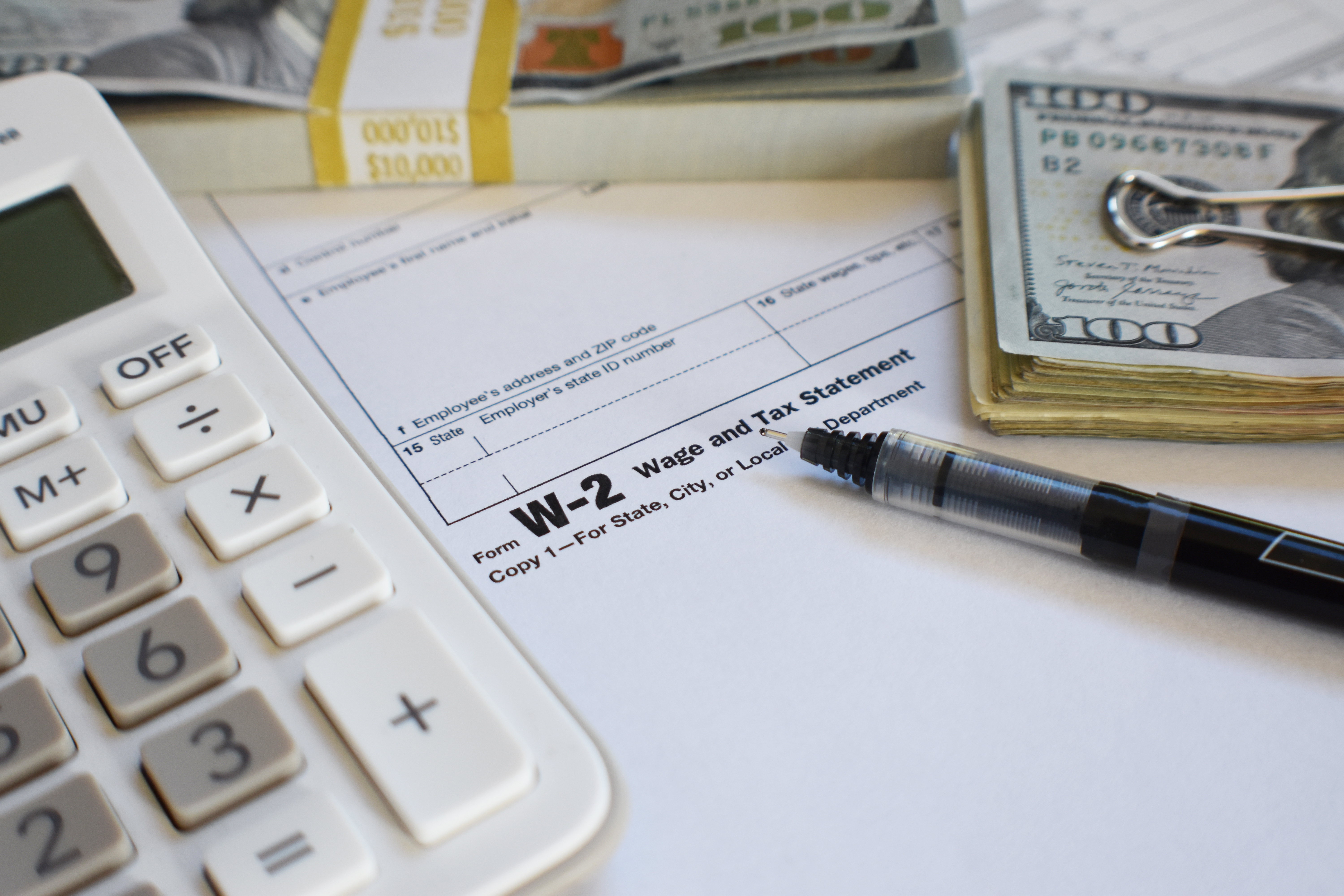

Will I Receive a 1099 or W-2 for Workers Compensation. Learn About Workers Comp Law and Find a Workers Comp Attorney to help you with your Work Injury Case. The short answer to this question is no taxes are not normally taken out of workers compensation.

The IRS does not allow you to deduct workers comp benefits on your tax return. No workers compensation benefits are not taxable at either the federal or the state level theyre generally. Reporting promptly to the Treasury Inspector General for Tax Administration TIGTA any claims or allegations of workers compensation fraud.

Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes. If your total monthly workers compensation benefits or your benefits plus other income are more than the maximum SSI monthly payment amount your SSI application. If an employer hires an illegal does the employer lose the exclusive remedy provision under work comp.

While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. Your workers compensation benefits will be subtracted from your taxable income. IRS Publication 525 pg.

Finding an experienced and good workmans compensation lawyer is a bit hard especially if this is the first time youll be availing. Are taxes normally taken out of workers compensation payments. The quick answer is that generally workers compensation benefits.

A recent decision New York Hospital Medical Center of Queens v. Posted on November 30 2021. The OWCP approved a.

Report the amount shown in box 14 of your T4 slips on line 10100 of your Income Tax and. Do I have to Pay Taxes on Workers Comp Benefits. This ensures that you are not taxed on both amounts.

This deduction allows your workers compensation benefits to be deducted from your income. Do you have to claim workers compensation when filing taxes. As stated above workers compensation benefits are entirely tax free.

How do I choose a workmans compensation lawyer. In the eyes of the IRS workers compensation insurance is typically tax-deductible. 247 Toll Free Help Line.

Is workers comp tax deductible. You should consult with your accountant to. You should not receive a 1099 form.

How To Avoid Paying Taxes On A Lawsuit Settlement Smartasset

Do 1099 Employees Need Workers Compensation Landesblosch

Can I Deduct Nanny Expenses On My Tax Return Taxhub

What Are Payroll Taxes An Employer S Guide Wrapbook

25 Small Business Tax Deductions You Should Know About Hourly Inc

Is Workers Compensation Taxable The Turbotax Blog

Mandatory Vs Voluntary Payroll Deductions

Payroll Tax Calculator For Employers Gusto

Patriot Software Full Service Payroll Review Pcmag

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Is Workers Comp Taxable No Unless

Is Workers Comp Taxable Workers Comp Taxes

The Consequences Of Intentionally Manipulating Workers Comp Premiums

6 Common Mistakes On Workers Comp Audits That Can Cost You Hourly Inc

Are Nonprofit Employee Benefits Tax Deductible Business Benefits Group

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Do I Have To Report Workers Compensation On My Taxes New Jersey Workers Compensation Lawyers Petro Cohen P C

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen